DEVELOPMENT FUNDING BASED AROUND YOUR NEEDS

We specialise in providing innovative and creative funding options, structured for each project.

WE'RE PROBLEM-SOLVERS, TOO

CCAM is part of a non-bank lending fraternity growing its market share by providing funding solutions that solve common issues borrowers are confronted with. These are just some of the roadblocks we can help you navigate:

SOLUTIONS ACROSS THE CAPITAL STACK

- Senior Debt — first mortgage secured up to 65% LVR, with loan amounts from $750,000 up to $25million.

- Stretch Senior or Uni-tranche (combination of first and second mortgages) up to 75% LVR.

- Second mortgages up to 75% LVR minimum loan amount $300,000.

- Structured finance including Mezzanine and Preferential Equity.

- Equity where appropriate for strong sponsors with a track-record.

- Equity financing in special situations

-

Equity release to deploy capital and progress other projects

Working with a large developer with several land development projects, CCAM provided senior debt facility up to 60% LVR to refinance remaining lots in Stage 1 and . .

Find out more. -

Simple built form construction

The construction of 25 apartments. Senior debt arranged up to 65% LVR and funded preferred equity to cover equity shortfall over 22 months. This enabled . .

Find out more. -

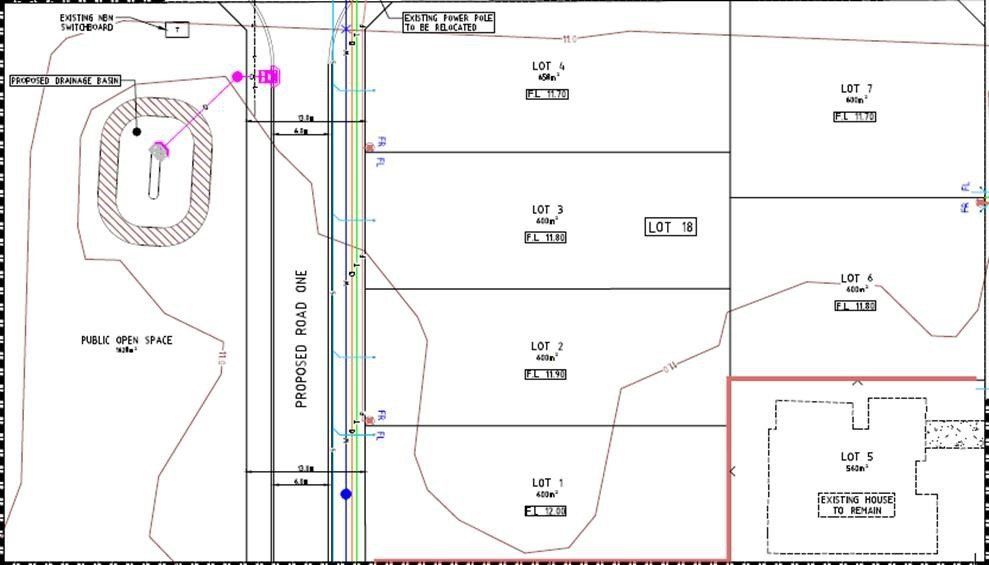

Land development

A seven-lot land subdivision without pre-sales. Senior debt provided up to 65% LVR and preferred equity to fund equity shortfall over 15 months. This enabled the client to acquire . . .

Find out more. -

Site acquisition and preparing for construction

Funding for site acquisition for future apartment development. Senior debt was applied for, but valuation came in below estimates. As a . .

Find out more. -

Residual stock

This project included 22 apartments, partly sold. Stretch senior debt provided up to 70% LVR, which enabled the client to refinance a construction loan . . .

Find out more. -

Land development

A 20-lot land subdivision without pre-sales. Senior debt provided up to 65% LVR over 15 months to enable our client to acquire the site . . .

Find out more.

LET'S WORK TOGETHER

Okay, I'm ready

Contact Crest Capital for Property Development Finance Today

Crest Capital Asset Management | Privacy Policy